State Fiscal Highlights

|

STATE FUND |

FY 2010 – FUTURE YEARS |

|

General Revenue Fund |

|

|

Revenues |

|

|

Expenditures |

Potential increase for Attorney General legal expenses |

|

Consumer Finance Fund (Fund 5530) – Department of Commerce |

|

|

Revenues |

Potential significant loss in fee revenue; potential minimal gain in fine revenue from increased penalties |

|

Expenditures |

Potential decrease corresponding to revenue losses |

|

Consumer Protection Enforcement Fund (Fund 6310) – Attorney General's Office |

|

|

Revenues |

Potential gain from civil penalties |

|

Expenditures |

Potential increase for legal expenses |

|

Victims of Crime/Reparations Fund (Fund 4020) – Attorney General's Office |

|

|

Revenues |

Potential minimal gain from court costs |

|

Expenditures |

- 0 - |

|

Note: The state fiscal year is July 1 through June 30. For example, FY 2010 is July 1, 2009 – June 30, 2010. |

|

Department of Commerce – Consumer Finance Fund

· The interest rate and fee limitations in the bill will cause some, if not many, short-term, small-dollar consumer lenders to adjust their business plans, either by modifying their loan products to comply with the new lending requirements in the bill or by leaving the loan market in Ohio. If lenders leave the loan market, license revenue deposited in the Consumer Finance Fund (Fund 5530) could decline significantly.

· A decline in Fund 5530 revenue may result in adjustments to consumer outreach, complaint intake, and other services. Compliance, examination, and enforcement activities would remain a priority.

· Fund 5530 may experience a minimal gain in fine revenue from increased or new fine amounts for certain violations.

Attorney General – Consumer Protection Enforcement Fund and GRF

· The bill applies the Consumer Sales Practices Act (CSPA) to loans of $1,000 or less made under the Small Loan Act or the Ohio Mortgage Loan Act. As a result, the number of cases handled by the Office of the Attorney General's Consumer Protection Section, funded from the GRF and the Consumer Protection Enforcement Fund (Fund 6310) could increase, although the number of complaints filed, investigations performed, and enforcement actions is uncertain. Civil penalties resulting from the bill would be deposited in Fund 6310.

State Court Cost Revenue – GRF and Victims of Crime/Reparations Fund

· The bill could lead to new prosecutions and convictions. If so, the state may gain locally collected court cost revenues that are deposited in the GRF and the Victims of Crime/Reparations Fund (Fund 4020).

Local Fiscal Highlights

|

LOCAL GOVERNMENT |

FY 2010 – FUTURE YEARS |

|

|

Counties and Municipalities |

||

|

Revenues |

Potential gain from court costs, filing fees, fines, and (for counties only) CSPA civil penalties |

|

|

Expenditures |

Potential increase for new civil and criminal cases |

|

|

Note: For most local governments, the fiscal year is the calendar year. The school district fiscal year is July 1 through June 30. |

||

Local Justice System Revenues and Expenditures

· As a result of the new penalties this bill contains, some persons who may not have been successfully prosecuted and convicted under existing law could be prosecuted and sanctioned. This could in turn increase local criminal justice costs for investigating, prosecuting, adjudicating, and sanctioning offenders. It is uncertain how many new cases will result from these penalties, but there may be additional court cost, filing fee, and fine revenues collected by county and municipal criminal justice systems statewide, offseting some of the additional cost.

· The application of the bill's expanded enforcement measures to loans of $1,000 or less made under the Small Loan Act and the Ohio Mortgage Loan Act may result in an increase in civil cases filed in county or municipal courts. If so, this would generate some additional filing fee and court cost revenue for counties and municipalities and place some additional burdens on the courts that will have to adjudicate these matters. Counties would also receive a portion of civil penalty revenue in successfully-pursued CSPA cases.

Detailed Fiscal Analysis

Overview

The bill establishes various new restrictions regarding

small and short-term loans in response to the actions of the payday lending

industry in the wake of the passage of Am. Sub. H.B. 545 of the 127th General

Assembly, which became effective

September 1, 2008. H.B. 545 eliminated the check-casher lender license and

created a short-term loan license that limited the interest on such short-term

loans to an annual percentage rate (APR) of 28%. The interest limitation

resulted in a migration of industry operators to licensure under alternate

lending statutes. The table below illustrates consumer finance licensure

activity for certain license types between June 30, 2008 and September 21, 2009,

derived from active licensure statistics provided by the Department of

Commerce's Division of Financial Institutions (DFI) as of the end of FY 2008

and the license roster available online at the Department of Commerce web site.

|

Table 1: Selected Consumer Finance Licensure Activity |

||||

|

License Type |

June 30, 2008 |

September 21, 2009 |

Change |

|

|

Check Casher |

1,680 |

999 |

(681) |

|

|

Check- Casher Lender |

1,577 |

0 |

(1,577) |

|

|

Mortgage Loan Act |

1,175 |

1,573 |

398 |

|

|

Small Loan Act |

11 |

514 |

503 |

|

|

Short Term Loan |

N/A |

1 |

1 |

|

|

Total |

4,443 |

3,087 |

(1,356) |

|

|

|

|

|||

As the table shows, many licensed check casher lenders have moved to licensure under the Small Loan Act (SLA) and the Ohio Mortgage Loan Act (OMLA) with only 1 lender operating under the Short Term Loan license that H.B. 545 created. DFI estimates that there are approximately 835 former check casher lender storefronts currently operating under a different license. Depending on the law that the lender is operating under, these alternate lending statutes permit APRs of between 21% and 28% and a graduated scale of origination fees based on the size of the loan. Details concerning allowable loan terms for loans made under the SLA or OMLA are found in the LSC Bill Analysis.

DFI has found that many of the former payday lenders have been able to stay in business under the SLA and OMLA, even though they have lower allowable APRs, by changing their business model to issue loan proceeds using a check and subsequently offering to cash that check for a fee. In response, the bill limits SLA and OMLA lenders from making a loan of $1,000 or less that will obligate the borrower to pay more than 28% APR unless the loan meets certain requirements and prohibits charging fees to cash checks issued to fund a loan. The bill expands the enforcement options available for SLA and OMLA loans of $1,000 or less by making certain violations of the SLA and OMLA involving those loans subject to the Consumer Sales Practices Act (CSPA) and by applying existing enforcement methods available under the Short Term Loan Law to such SLA and OMLA loans. Finally, the bill increases the range of fines for certain violations of the OMLA and creates new penalties for out-of-state lenders making SLA and OMLA loans from an out-of-state office to borrowers in Ohio, charging a fee to cash a check issued to fund a loan, and violating the interest rate and fee limitations in the bill. Overall, provisions of the bill would affect both the operations of DFI and the Attorney General's Consumer Protection Section. The fiscal effects of these provisions are discussed below.

Fiscal Effects

Interest rate and fee limitations – potential loss in fee revenue

As noted above, the bill modifies the SLA and the OMLA to prohibit a lender from making a loan of $1,000 or less that will obligate the borrower to pay more than 28% APR, including all charges, fees, and so forth, unless the term of the loan is greater than three months or the loan contract requires more than three installments. The 28% APR limitation is consistent with the limitation on loans made under the short-term loan license created in Am. Sub. H.B. 545, though those loans have a duration of no more than 31 days and maximum amount of $500.

The fiscal effect of this provision, in concert with the

prohibition on charging fees for cashing checks issued to fund a loan, would

depend on how much of an SLA or OMLA lender's portfolio is made up of

sub-$1,000 loans. There is some evidence to suggest that sub-$1,000 loans make

up a large part of some such licensees' businesses. Though the Ohio Department

of Commerce does not have loan amount information for OMLA licensees, it does

maintain statistics for SLA licensees. During CY 2008, SLA licensees

originated 73,286 loans with loan amounts of $1,000 or less, totaling

$26.0 million. Of the SLA licensees making such loans, loans of under $1,000

were 90% of their loan origination activity in most cases. Thus, the interest

rate limitations and fees in the bill may have a substantial impact on the

business operations of these lenders given the constraints they pose to store

profitability.

As evidence of this, research on the payday lending industry indicates that average costs (including loan defaults) for a store open at least one year to loan $100 were between $11 to $14, depending on the age of the store. Shared administrative and interest expenses allocated by the payday lending firm at the corporate level add another $3 to $5 in costs per $100 loaned.[1] Under the bill, a $505 loan for 14 days at 28% APR would permit a finance charge of $5.42. [2] In contrast, the same loan under the SLA would result in a finance charge of $35.42, not including any additional fees a lender may charge for cashing a check.

Therefore, in all likelihood the changes made by the bill will cause lenders to adjust their business plans, either by leaving the loan market in Ohio or by modifying their loan products to comply with the new lending requirements in the bill or those unchanged in current law. It seems reasonable to assume that some, if not many, SLA and OMLA lenders, particularly the former check-casher lenders that migrated to those licenses, might choose to cease business in the state, resulting in a loss in license fee revenue to the Consumer Finance Fund (Fund 5530). Though the amount of any revenue loss is uncertain, the 835 former check-casher lender storefronts currently operating under a different license represent about $250,000 in annual renewal fee revenue, given that the renewal fee for SLA licensees and OMLA registrants is $300. In addition, lenders foregoing business under a check-casher license would add to the revenue loss.

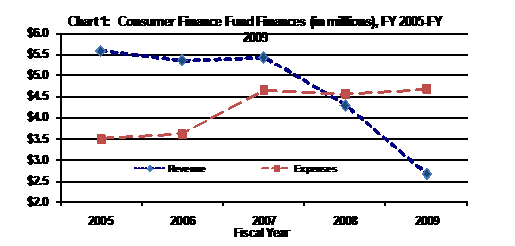

Due to statutory changes addressing predatory lending (S.B. 185 of the 126th General Assembly) and payday lending (H.B. 545 of the 127th General Assembly), Consumer Finance Fund revenue has declined in recent years. Meanwhile, the costs to regulate these entities and professions, which also include credit services organizations, insurance premium finance companies, mortgage brokers, loan officers, pawnbrokers, and precious metals dealers, has increased due to expanded licensing requirements and enforcement. The chart below illustrates the revenue and expenses (excluding transfers) of the Consumer Finance Fund over the last five fiscal years. The current cash balance of the fund is approximately $7.7 million.

|

DFI administrative costs

DFI oversees the administrative work of approximately 7,200 active consumer finance licenses, with OMLA and SLA lenders comprising about one-fourth of that number. DFI's Consumer Finance program, which employs 24 people (with four openings that are intended to be filled), also regulates other consumer finance occupations and companies such as mortgage brokers, pawnbrokers, precious metals dealers, insurance premium finance companies, and credit services organizations. None of these employees works exclusively on OMLA or SLA issues. Rather, DFI assigns these employees by function. So, field examiners perform examinations of mortgage brokers, SLA lenders, pawnbrokers and so forth, while licensing staff work on all license types.

Because of the decline in Consumer Finance Fund revenue, DFI began a staff restructuring of the Consumer Finance program in FY 2008 to improve efficiency while also maintaining its compliance, examination and enforcement responsibilities. At that time (October 2007), the Consumer Finance program had a staff of 38. The reductions have come through attrition and an early retirement incentive program.

Significant revenue reductions resulting from the bill may be offset by an increase in the number of loan originator (formerly loan officer) licenses as a result of changes to the Mortgage Broker Law and Mortgage Loan Law in Am. Sub. H.B. 1 of the 128th General Assembly, the main operating budget act for FY 2010-FY 2011. DFI indicated that current levels of compliance, examination, and enforcement efforts would be affected depending on the degree of the revenue decline. Although compliance, examination, and enforcement would remain a priority, a decline in revenue could require adjustments in the consumer outreach, complaint intake, and other services paid for by the Consumer Finance Fund.

Enforcement provisions

Historically, DFI has received very few complaints regarding the small dollar, short term loan industry, but there may be additional enforcement actions given the expanded enforcement powers in the bill, depending on how the industry reacts to the changes. The bill applies the enforcement mechanisms applicable to the Short-Term Loan Law enacted in H.B. 545 to certain violations of the SLA and OMLA when the violation involves a loan of $1,000 or less. These violations include: making a loan without being properly licensed; making false, misleading, or deceptive advertisements; concealing an evasion of the SLA or OMLA through the use of another business; making a loan in violation of interest and fee limitations; engaging in prohibited debt collection practices; and so forth. The enhanced enforcement mechanisms include application of the Consumer Sales Practices Act and the ability of the Superintendent of Financial Institutions or local prosecutors to bring a civil action or initiate criminal proceedings. These enforcement mechanisms are described in more detail below.

Attorney General – Consumer Sales Practices Act

Under current law, the Office of the Attorney General has the authority to bring civil actions to enjoin violations of the SLA and OMLA. The bill makes certain violations of the OMLA and SLA, involving loans of $1,000 or less, an unfair or deceptive trade practice subject to the remedies available in the CSPA. Sometimes, a CSPA case will originate with DFI. In such a circumstance, DFI would investigate for alleged violations of the lending statute prior to making any CSPA or criminal referral. If there is sufficient evidence indicating a CSPA or criminal violation has taken place, DFI would make a referral to AGO or the appropriate county prosecutor, methods that resemble how its efforts are coordinated with AGO in such cases under the Mortgage Broker Law.

As a result of the bill, the number of transactions handled by the AGO's Consumer Protection Section is likely to increase. However, the actual number of cases filed in county courts would most likely be relatively small as, under its current practice, AGO would seek to use every means available to resolve the complaint before filing in court. The number and magnitude of related complaints filed, investigations performed, and enforcement actions that would be taken as a result of the bill are unknown. Thus, whether the bill will create additional ongoing operating expenses to the Consumer Protection Section, as well as the amount of those potential costs, is uncertain. These expenses would be borne by the GRF and the Consumer Protection Enforcement Fund (Fund 6130).

Alternatively, a consumer injured by a violation of the new sections would also be able to pursue civil remedies. It is uncertain how many consumers will elect to pursue a civil remedy without the assistance of AGO, but the number is assumed to be small as injured persons would, most likely, report a complaint to AGO initially and then allow the Consumer Protection Section to seek a resolution to the complaint.

If a CSPA case goes to trial and is resolved in AGO's favor, the court can award AGO all costs and expenses associated with the investigation, in addition to reasonable attorney's fees. The court may also order civil penalties up to $25,000. Three-quarters of this civil penalty (as much as $18,750 if the maximum $25,000 possible fine is assessed), as well as the investigation costs and attorney's fees, would be credited to Fund 6310. The remaining one-quarter of the civil penalty that violators could be ordered to pay would go to the treasury of the county where the case took place (as much as $6,250 if the $25,000 maximum possible fine is assessed).

If additional civil suits are filed because of the expansion of the CSPA to cover small-dollar, short term loans made under the SLA or OMLA, some additional burdens would be placed on the county and municipal courts that will have to adjudicate these matters while some additional filing fee and court cost revenue would be generated for those entities.

DFI/Local prosecutor involvement

In addition to making the specified violations subject to the CSPA, the bill also allows the Superintendent of Financial Institutions or, under certain circumstances, the applicable county prosecutor to bring a civil action to enjoin a violation. The Superintendent may also initiate criminal proceedings for a violation by presenting evidence of criminal violations to the applicable county prosecutor. The county prosecutor may go forward with the case, or initiate criminal proceedings on his or her own. If a county prosecutor does not agree to go forward with the case in a reasonable period of time, the bill authorizes the Attorney General to initiate the criminal proceedings.

Overall, the number and magnitude of related complaints filed, investigations performed, and enforcement actions that would be taken as a result of the bill by DFI or county prosecutors are unknown. Thus, whether the bill will create additional ongoing operating expenses for either DFI or county prosecutors, and what these costs might be, is uncertain.

New prohibitions and increased fines – state and local criminal justice effects

The bill creates several new prohibitions and related-penalties aimed at protecting consumers. The table below lists those penalties included in the bill as well as the potential maximum prison sentence and fine. At the state level, the GRF and the Victims of Crime/Reparations Fund (Fund 4020) may experience a minimal gain in the amount of court cost revenue from the criminal penalties below. The Consumer Finance Fund (Fund 5530) may experience a minimal gain in revenue from the other penalties punishable by fine. Violators of felonies of the fifth and fourth degrees typically are not sentenced to prison, as there is a preference against such an action unless the offense involves certain drug offenses. As such, it is not likely that the state will incur incarceration expenses.

At the local level, the bill's provisions could increase local criminal justice expenditures related to investigating, prosecuting, adjudicating, and sanctioning offenders. However, it is uncertain how many new cases would result from the bill's new penalties. Any increase in costs related to prosecuting and adjudicating these cases may be at least somewhat offset through court cost and fine revenue, making it likely that any additional cost would not be more than minimal.

|

New Criminal Penalties Associated with Consumer Lending |

||||

|

Offense |

ORC Reference |

Penalty |

Possible Prison Term |

Possible fine |

|

A person not located in Ohio making a loan to a borrower in Ohio from an office not located in Ohio under the Small Loan Act or the Ohio Mortgage Loan Act |

1321.02; 1321.52(A); 1321.99(A) |

Felony of the 5th Degree |

6, 7, 8, 9, 10, 11, or 12 months |

Not more than $2,500 |

|

Charging or receiving a fee for cashing a proceeds check or money order that was disbursed to fund a loan under the Small Loan Act; Requiring a borrower to cash such a check or money order at their business, at an affiliate, or at any specified third party |

1321.13(L); 1321.99(B)

|

N/A |

Not more than 6 months |

$100-$500 |

|

Charging or receiving a fee for cashing a proceeds check or money order that was disbursed to fund a loan under the Ohio Mortgage Loan Act; Requiring a borrower to cash such a check or money order at their business, at an affiliate, or at any specified third party |

1321.57(M); 1321.99(D) |

N/A |

N/A |

$500-$1,000 |

|

Making a loan under the Small Loan Act or the Ohio Mortgage Loan Act of $1,000 or less that does not conform to the 28% APR limitation provisions |

1321.15(C); 1321.59(E); 1321.99(D) |

N/A |

N/A |

$500-$1,000 |

In addition, the bill increases the range of fines associated with certain violations of the Ohio Mortgage Loan Act not involving loans of $1,000 or less, such as making a loan that does not comply with the interest and fee limitations in that Act, entering into more than one contract with a borrower at the same time to obtain higher charges than otherwise permitted, refusing to provide information regarding the amount required to pay a loan in full, paying or receiving excessive fees for brokering a loan secured by real estate, or making false, misleading, or deceptive advertisements. Under current law, the fine for these activities ranges from $100 to $500. Under the bill, the fine could be set anywhere between $500 and $1,000.

HB0209IN.docx/th